10 Common Tax Deductions Missed in 2025 That Cost You Money

Tax season often feels like a race against the clock, with many of us opting for the simplest path forward to meet the deadline. In that rush, it’s incredibly easy to overlook valuable write-offs that could significantly lower your tax bill. Every year, hardworking taxpayers overpay by hundreds, even thousands, of dollars simply because they aren’t aware of all the common tax deductions missed. These aren’t obscure loopholes for the ultra-wealthy; they are legitimate, accessible deductions for everyday expenses.

From the home office you now use daily to the vehicle mileage you accrue for business errands, these missed opportunities quickly add up. This guide is designed to shine a light on the 10 most frequently overlooked deductions, ensuring you claim every dollar you deserve. We’ll break down who qualifies for each, what documentation is required, and the common pitfalls to avoid.

1. Home Office Deduction

The explosion of remote work and self-employment has made the Home Office Deduction more relevant than ever, yet it remains one of the most common tax deductions missed by eligible taxpayers. This valuable deduction allows you to write off a portion of your home’s expenses if you use part of your home exclusively and regularly for your trade or business.

This deduction is primarily for self-employed individuals, freelancers, and independent contractors. Unfortunately, due to the Tax Cuts and Jobs Act of 2017, W-2 employees can no longer claim this deduction, even if their employer requires them to work from home.

How It Works: Two Methods

The IRS provides two ways to calculate this deduction, each with its own benefits.

- The Simplified Method: This is the easiest approach. You can deduct $5 per square foot of your home office, up to a maximum of 300 square feet. This caps the deduction at $1,500 per year and requires minimal record-keeping.

- The Regular Method: This method requires more detailed tracking but can yield a much larger deduction. You calculate the percentage of your home used for business (e.g., a 200-square-foot office in a 2,000-square-foot home is 10%). You can then deduct that percentage of your actual home expenses, including mortgage interest, property taxes, homeowners insurance, utilities, and repairs.

Key Insight: Choosing the right method is crucial. The simplified method is great for convenience, but if you have high housing costs and a larger dedicated workspace, the regular method will likely provide a significantly greater tax benefit.

Actionable Tips for Success

- Measure Accurately: Use a tape measure to determine the exact square footage of your office. Document this measurement and take photos to prove the space is used exclusively for business.

- Keep Meticulous Records: If using the regular method, keep every receipt and statement for home-related expenses. This includes utility bills, insurance premiums, and repair invoices.

- Understand “Exclusive Use”: Your home office must be a space used only for business. A desk in the corner of your family room generally doesn’t qualify. It should be a separate room or a distinctly partitioned area.

This is just one of many ways to lower your taxable income. For a broader look at tax-saving strategies, explore our guide on how to maximize your tax deductions.

2. Business Meals and Entertainment Deduction

The rules around deducting business meals and entertainment have changed significantly in recent years, causing confusion and leading many business owners to miss out on legitimate write-offs. This deduction allows you to subtract the cost of ordinary and necessary food and beverage expenses incurred while conducting business, making it a crucial one for entrepreneurs, freelancers, and sales professionals.

While the extravagant “three-martini lunch” era is long gone, the IRS still permits valuable deductions. Generally, business meals with clients, partners, or employees are 50% deductible if they are not lavish and you (or an employee) are present. Entertainment expenses, like tickets to a sporting event, are no longer deductible.

How It Works: The 50% Rule

The core of this deduction is straightforward, but documentation is everything.

- Standard 50% Deduction: For most business-related meals, you can deduct 50% of the total cost. This includes the food, beverages, taxes, and tips. For example, a $150 client dinner results in a $75 deduction. This applies to meals while traveling for business or taking a client out to discuss a project.

- Temporary 100% Deduction: For 2021 and 2022, a special rule allowed for a 100% deduction for business meals purchased from a restaurant. This temporary provision has expired, so the 50% limit is back in effect for 2023 and beyond.

Key Insight: The distinction between meals and entertainment is critical. If you take a client to dinner and then a concert, only the cost of the dinner is potentially deductible. You must separate the expenses clearly in your records.

Actionable Tips for Success

- Document the Business Purpose: On every receipt, immediately write down who attended the meal and the specific business topic discussed. Simply writing “client lunch” is not enough for the IRS.

- Keep Itemized Receipts: Credit card statements are not sufficient proof. You must keep the itemized receipt showing what was purchased. This proves the expense was for food and beverages, not non-deductible entertainment.

- Separate Meal and Entertainment Costs: If an event includes both a meal and entertainment, ask for a separate bill for the food and drinks. If the costs are not stated separately on the invoice, none of it is deductible.

Properly tracking these expenses is vital for surviving an audit. To learn more about substantiating your business expenses, see our guide on how to maintain audit-proof records.

3. Professional Development and Education Expenses

Investing in your career is a smart move, but many people don’t realize they can get a tax break for it. The deduction for professional development and education expenses is one of the most frequently overlooked tax benefits, allowing you to write off costs incurred to maintain or improve the skills required in your current profession.

This deduction is available to self-employed individuals and, in some specific cases, W-2 employees. The key distinction is that the education must maintain or improve skills for your present job. Expenses for education that would qualify you for a new trade or business are generally not deductible.

What Qualifies as a Deductible Expense?

The IRS allows for a broad range of costs, as long as they directly relate to your existing work.

- Tuition and Fees: This includes the cost of courses at a college, university, or vocational school.

- Professional Development: Costs for seminars, webinars, and conferences that enhance your expertise. For example, a software developer attending a coding conference or an attorney taking continuing legal education (CLE) courses.

- Certifications and Licenses: Fees for professional certifications, such as a CPA exam prep course for an accountant, or license renewal fees.

- Related Costs: This can also include books, supplies, and even travel expenses if you must go away overnight for the training.

Key Insight: The primary test for this deduction is whether the expense helps you excel in your current role. Documenting this connection is essential, as education for a career change does not qualify.

Actionable Tips for Success

- Document the “Why”: Keep a note with your receipts explaining how each course or conference directly relates to improving skills for your current job. A syllabus or event agenda can serve as excellent proof.

- Separate Your Expenses: If you travel for a conference, keep meticulous records of your transportation, lodging, and meal costs. Only expenses directly related to the educational event are deductible.

- Keep All Proof of Payment: Retain every invoice, receipt, and bank statement related to your educational expenses. Certificates of completion are also valuable documentation to have on hand.

4. Vehicle Mileage Deduction

For freelancers, small business owners, and gig workers, vehicle expenses are often a significant cost of doing business. The Vehicle Mileage Deduction is a powerful tool to recoup these costs, yet many eligible taxpayers fail to claim its full value, making it one of the most common tax deductions missed. This deduction allows you to write off the costs of using your car for business purposes, such as driving to meet clients, traveling between job sites, or making deliveries.

It’s important to note that the drive from your home to your primary place of work (your regular commute) is not deductible. However, travel from your office to a client’s location, or between multiple business locations, absolutely qualifies.

How It Works: Two Methods

Just like the home office deduction, the IRS offers two methods for calculating your vehicle expenses.

- The Standard Mileage Rate: This is the most straightforward option. You multiply your total business miles driven during the year by a standard rate set by the IRS. For 2024, this rate is 67 cents per mile. A real estate agent who drives 25,000 business miles could claim a deduction of $16,750 with this method.

- The Actual Expense Method: This method involves tracking all the actual costs of operating your vehicle for the year. You then calculate the percentage of business use (business miles divided by total miles) and deduct that portion of your total expenses, which can include gas, oil changes, insurance, registration fees, repairs, and vehicle depreciation.

Key Insight: The standard mileage rate is simple and often yields a high deduction without intense record-keeping. The actual expense method may be more beneficial if you have a newer, more expensive vehicle with high depreciation or significant repair costs.

Actionable Tips for Success

- Keep a Contemporaneous Log: The IRS requires a detailed and timely mileage log. Record the date, starting and ending odometer readings, total mileage, and the business purpose for each trip.

- Leverage Technology: Manually logging every trip is tedious. Use a dedicated mileage-tracking app like MileIQ or Stride to automatically record your drives and easily classify them as business or personal.

- Don’t Forget Associated Costs: Even if you use the standard mileage rate, you can still deduct business-related parking fees and tolls separately. Keep receipts for these expenses.

Tracking business mileage is essential for maximizing your return. To learn more about other overlooked deductions, check out our guide on the ultimate list of tax write-offs for the self-employed.

5. Medical and Dental Expenses (Self-Employed Health Insurance)

For the growing ranks of freelancers and small business owners, managing healthcare costs is a major concern. The Self-Employed Health Insurance Deduction is a powerful, yet often overlooked, tax benefit that directly addresses this challenge. This valuable deduction allows you to subtract the cost of medical, dental, and qualified long-term care insurance premiums for yourself, your spouse, and your dependents.

This is an “above-the-line” deduction, meaning you can claim it even if you take the standard deduction. It directly reduces your adjusted gross income (AGI), which can help you qualify for other tax credits and deductions. To be eligible, you must have a net profit from your business, and the policy can be established either under your business or your own name.

How It Works

The deduction is straightforward but has important limitations. You can deduct 100% of the health and dental insurance premiums you paid, but the total deduction cannot exceed the net profit from your self-employment business. For instance, if your business earned a net profit of $50,000 and you paid $15,000 in health insurance premiums, you can deduct the full $15,000. However, if your premiums were $15,000 and your net profit was only $12,000, your deduction would be capped at $12,000.

This deduction is claimed on Schedule 1 of your Form 1040. It’s crucial to note that you generally cannot claim this deduction if you or your spouse were eligible to participate in an employer-subsidized health plan, even if you chose not to enroll.

Key Insight: This is not an itemized deduction for medical expenses on Schedule A. It is a separate, more advantageous deduction for self-employed individuals that directly lowers your AGI, making it one of the most impactful common tax deductions missed.

Actionable Tips for Success

- Confirm Your Eligibility: Before tax time, verify that you were not eligible for an employer-sponsored plan through your own job (if you have one) or your spouse’s. This is a common point of confusion that can lead to an incorrect claim.

- Keep Meticulous Records: Retain all documents proving you paid the premiums, such as bank statements, canceled checks, and policy statements (Form 1095-A, B, or C). These records are essential in case of an IRS inquiry.

- Track Your Business Profit: Your deduction is limited by your net business income. Maintain accurate bookkeeping throughout the year to ensure you know your profit and can correctly calculate the maximum allowable deduction.

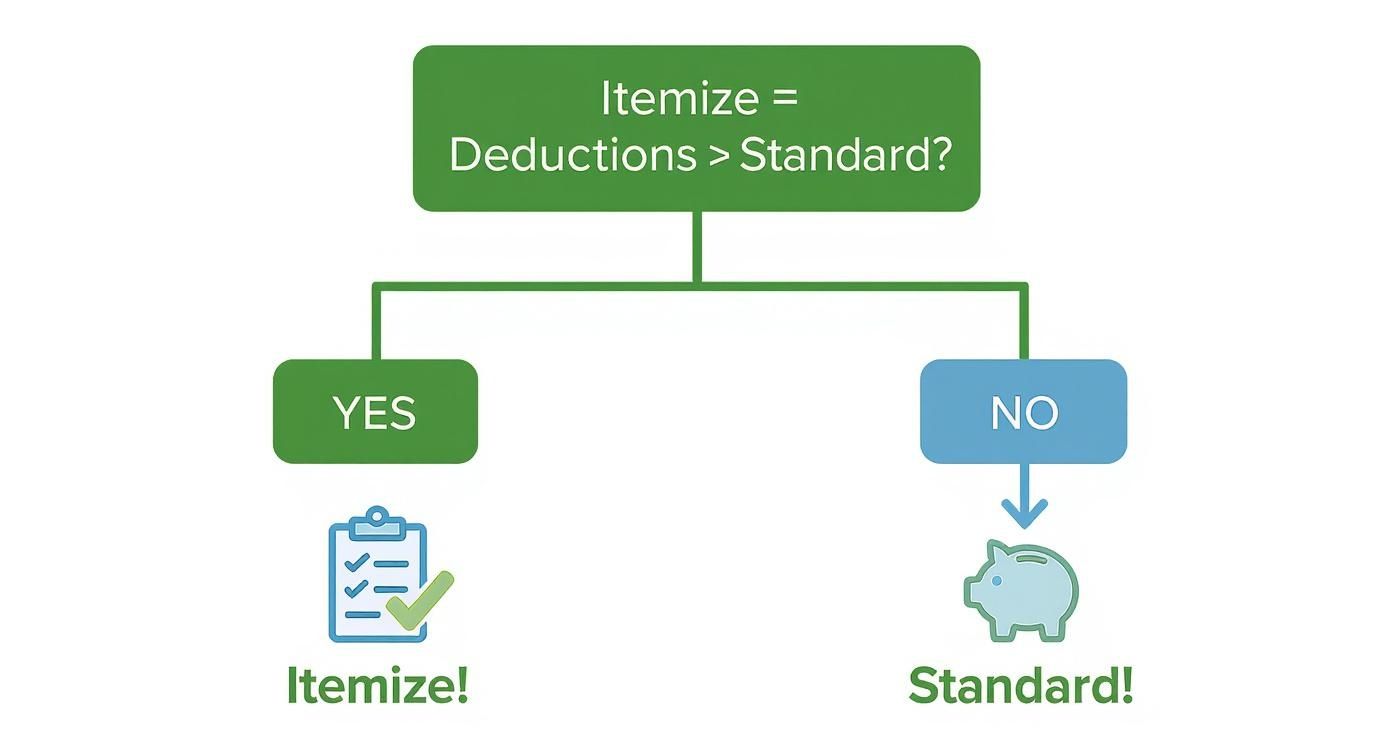

Understanding how different deductions interact is key to a solid tax strategy. For a deeper dive into your options, check out our guide on the itemized deduction vs. standard deduction.

6. Charitable Contributions and Donations

Giving back is rewarding, but it can also provide a significant tax benefit. Yet, many taxpayers fail to deduct the full value of their generosity, making the deduction for charitable contributions one of the most common tax deductions missed. This is often due to poor record-keeping or uncertainty about what qualifies. This deduction allows taxpayers who itemize to reduce their taxable income by the value of what they give to qualified charitable organizations.

It covers cash donations, payroll deductions, and non-cash items like clothing, household goods, vehicles, and appreciated stocks. Proper documentation and accurate valuation are the keys to unlocking this powerful write-off and maximizing your itemized deductions.

How It Works: Cash vs. Non-Cash Donations

The IRS has specific rules for valuing and documenting different types of donations.

- Cash Contributions: The most straightforward donation type, including contributions by cash, check, or credit card. You can generally deduct the full amount given to a qualified organization.

- Non-Cash Contributions: This includes donating goods like clothing, furniture, or electronics. For these items, you deduct their fair market value (FMV)—what they would sell for in their current condition—at the time of donation. For high-value items, special rules may apply.

Key Insight: Donating appreciated stocks held for more than a year is a powerful tax-saving strategy. You can typically deduct the full fair market value of the stock and avoid paying capital gains tax on the appreciation—a double tax benefit.

Actionable Tips for Success

- Keep Meticulous Records: The IRS requires proof. For any single contribution of $250 or more (cash or non-cash), you must have a written acknowledgment from the charity. For smaller donations, a bank record or receipt is sufficient.

- Value Items Correctly: For non-cash items, determining the fair market value is critical. This is where many taxpayers who previously used Intuit’s ItsDeductible now need an effective replacement. Tools that assist in calculating FMV are invaluable for maximizing this deduction.

- Track Related Expenses: Don’t forget to deduct out-of-pocket expenses incurred while volunteering. This includes the cost of supplies and mileage driven for the charity, which can be deducted at a rate of 14 cents per mile.

Properly documenting non-cash donations is a hassle without the right system. As the best replacement for the now-deprecated ItsDeductible, DeductAble helps you accurately value and track your donated goods, ensuring you get the maximum deduction you deserve. For more details, review our guide on charitable donation receipt requirements.

7. Home Office Utilities and Services Deduction

While many who qualify for the home office deduction remember to claim rent or mortgage interest, a significant number overlook the powerful, related deductions for utilities and services. This is one of the most common tax deductions missed within the home office category, leaving substantial savings on the table. If you operate a business from home, you can deduct the business portion of costs like electricity, internet, and even software subscriptions.

This deduction is a component of the “regular method” for the home office deduction, available exclusively to self-employed individuals, freelancers, and independent contractors. It allows you to write off the portion of your household utility and service bills that are directly attributable to running your business.

How It Works: Proportional vs. Direct Expenses

Calculating this deduction involves separating your expenses into two categories.

- Indirect Expenses: These are costs that benefit your entire home, such as electricity, water, and internet service. You must determine the business-use percentage of your home (e.g., a 200-square-foot office in a 2,000-square-foot home is 10%). You can then deduct that percentage of each utility bill. A $200 monthly internet bill would yield a $20 monthly deduction ($200 x 10%).

- Direct Expenses: These are costs that are 100% for your business. A common example is a dedicated business phone line installed in your home office. Since this service is used exclusively for your business, you can deduct the entire cost without proration.

Key Insight: Don’t just stop at the big utilities like power and internet. The business portion of services like home security, trash removal, and general home maintenance can also be included in your calculation, often adding hundreds of dollars to your total deduction.

Actionable Tips for Success

- Allocate Your Bills: At the end of each month, review your utility bills (electricity, gas, water, internet) and apply your home office percentage to calculate the deductible portion. Keep a running log in a spreadsheet.

- Separate When Possible: Consider getting a dedicated business phone line or internet service if your work demands it. This makes the expense a direct, 100% deductible cost and simplifies record-keeping.

- Track All Service Subscriptions: Keep meticulous records of all software subscriptions (e.g., Adobe Creative Cloud, Microsoft 365) and online services used exclusively for your business within your home office. These are often fully deductible.

By carefully tracking these often-forgotten expenses, you can significantly increase the value of your home office deduction. For more on maximizing your business-related write-offs, see our guide on essential tax deductions for the self-employed.

8. Office Supplies and Equipment Deduction

Every self-employed individual, from freelancers to small business owners, incurs costs for the tools of their trade. The Office Supplies and Equipment Deduction allows you to write off the costs of tangible items necessary to run your business, yet many fail to capture the full value of these everyday purchases.

This deduction covers everything from pens and paper to computers, software, and office furniture. For items that have a useful life of one year or less, you can generally deduct the full cost in the year you buy them. For more expensive, long-lasting items like machinery or a high-end computer, special rules apply that can provide significant tax savings.

How It Works: Expensing vs. Depreciating

Understanding the difference between supplies and equipment is key to maximizing this common tax deduction. The IRS provides specific rules for how to deduct these business assets.

- Supplies (Expensing): Items that are used up within one year, such as printer ink, paper, and postage, are considered supplies. You can deduct 100% of their cost in the year of purchase as a current business expense.

- Equipment (Depreciation or Section 179): More substantial items like computers, desks, and machinery are considered assets. You can either depreciate them, spreading the deduction over several years, or use a special rule called the Section 179 deduction to potentially expense the entire cost in the purchase year, up to certain limits.

Key Insight: The de minimis safe harbor election allows businesses to immediately expense items costing up to $2,500 per item. This simplifies bookkeeping and accelerates your tax savings, making it a powerful tool for small business owners.

Actionable Tips for Success

- Categorize Purchases Correctly: When you buy something, immediately decide if it’s a “supply” (used within a year) or “equipment” (a long-term asset). This will dictate how you record and deduct it.

- Keep Every Receipt: Meticulous record-keeping is non-negotiable. Save all digital and physical receipts for office-related purchases, no matter how small. A shoebox of receipts is better than nothing, but a digital system is best.

- Leverage Section 179: For significant equipment purchases, such as a new computer system or specialized machinery, talk to your tax professional about using the Section 179 deduction. This can dramatically reduce your taxable income for the year.

This is just one of many ways to lower your taxable income. For a broader look at tax-saving strategies, explore our guide on how to maximize your tax deductions.

9. Insurance Premiums Deduction (Business Liability and Property)

Protecting your business from risk is a fundamental cost of operating, and the IRS recognizes this by allowing you to deduct the premiums you pay for various business insurance policies. These deductions for ordinary and necessary insurance expenses are frequently underclaimed, yet they represent a significant opportunity for self-employed individuals and business owners to reduce their taxable income.

This deduction is available to anyone running a business, whether you’re a freelancer, independent contractor, or small business owner. The premiums paid for policies that cover fire, theft, flood, general liability, professional malpractice, and similar risks are all generally deductible. This also includes workers’ compensation and commercial vehicle insurance.

How It Works: Key Categories of Deductible Premiums

Deductible business insurance premiums cover a wide range of potential liabilities and losses, directly lowering your business’s net profit.

- Liability Insurance: This covers policies like general liability (for accidents or injuries) and professional liability (malpractice or “errors and omissions” insurance), which protect you from claims related to your business activities.

- Property & Asset Insurance: Premiums for policies covering your business property, such as commercial property insurance for an office or retail space, and insurance on business vehicles are deductible.

- Personnel-Related Insurance: This includes state-mandated workers’ compensation insurance, which covers employee job-related injuries or illnesses. Health insurance premiums paid for your employees are also a deductible business expense.

Key Insight: Don’t overlook this category of expenses. Insurance is not just a protective measure; it is a direct business cost that reduces your tax liability. Meticulously tracking these payments throughout the year can lead to substantial savings.

Actionable Tips for Success

- Separate Business from Personal: Ensure your business policies are distinct from your personal ones. For example, if you use your personal car for business, you can only deduct the business-use portion of your auto insurance premium.

- Keep Detailed Records: Maintain a file with all your insurance policies, declarations pages, and proof of premium payments (bank statements or canceled checks). This documentation is essential in case of an audit.

- Review Coverage Annually: Schedule an annual review of your business insurance needs. As your business grows or changes, your coverage requirements may shift, impacting your deductible premiums. This ensures you are both adequately protected and maximizing your deduction.

This is just one of many ways to lower your taxable income. For a broader look at tax-saving strategies, explore our guide on how to maximize your tax deductions.

10. Research and Development Tax Credit

While many entrepreneurs associate tax breaks with deductions, the Research and Development (R&D) Tax Credit is a powerful, yet frequently missed, opportunity to reduce your tax bill directly. Unlike a deduction that lowers taxable income, a credit reduces your tax liability dollar-for-dollar. It’s designed to reward businesses for investing in innovation to develop new or improved products, processes, or software.

This credit is not just for major corporations in lab coats; many small businesses and startups qualify without realizing it. The key is engaging in “qualified research activities,” which can include everything from developing a new manufacturing process to creating a proprietary software algorithm. Even activities that ultimately fail can qualify.

How It Works: A Direct Tax Reduction

The R&D tax credit calculation can be complex, but it generally rewards businesses for increasing their research spending. It’s calculated based on qualified research expenses (QREs), which typically include:

- Wages: Salaries paid to employees who are directly performing, supervising, or supporting R&D activities.

- Supplies: Costs of tangible supplies used and consumed during the research process.

- Contract Research: 65% of the amount paid to third-party contractors for conducting qualified research on your behalf.

For example, a tech startup that spends $200,000 on developer salaries and supplies for a new AI project could potentially generate a federal credit of $10,000 or more, plus potential state credits.

Key Insight: The R&D credit is retroactive. Businesses can often amend tax returns for the previous three years to claim credits they missed, potentially resulting in a significant cash refund from the IRS.

Actionable Tips for Success

- Document Contemporaneously: Don’t wait until tax time to build your case. Keep detailed project notes, test results, and meeting minutes that demonstrate your research process and technical uncertainties.

- Track Employee Time: Maintain records or time-tracking reports that show how much time each employee spends on qualified R&D activities versus routine tasks. This is crucial for accurately calculating wage expenses.

- Record Failures and Iterations: The R&D process is one of experimentation. Documenting failed attempts and design changes provides strong evidence that you were engaged in a process of discovery to eliminate technical uncertainty, which is a core requirement for the credit.

This powerful credit is one of many specialized tax strategies available. For a broader look at tax-saving opportunities, explore our guide on how to maximize your tax deductions.

Top 10 Missed Tax Deductions Comparison

| Deduction/Credit | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Impact | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Home Office Deduction | Medium 🔄 (simplified or regular methods) | Moderate ⚡: square footage, receipts, photos, Form 8829 | High 📊: substantial income reduction for qualifying space | Self-employed or remote workers with exclusive office space | Significant deduction; simplified option available |

| Business Meals & Entertainment Deduction | Low–Medium 🔄 (50% rule, documentation needed) | Low ⚡: itemized receipts, business purpose, attendee list | Medium 📊: partial deduction (generally 50%) | Client meetings, business travel, team meals | Common expense; often overlooked opportunity |

| Professional Development & Education Expenses | Low–Medium 🔄 (must relate to current job) | Moderate ⚡: invoices, certificates, syllabi, travel records | Low–Medium 📊: modest savings; preserves professional standing | Maintaining licenses, certifications, job-related courses | Encourages skill upkeep; broad eligible expenses |

| Vehicle Mileage Deduction | Low–Medium 🔄 (standard vs actual methods) | High ⚡: detailed contemporaneous mileage log or receipts | Medium–High 📊: significant for high-mileage users | Sales agents, delivery drivers, traveling consultants | Simple standard-rate option; can yield large deductions |

| Medical & Dental Expenses (Self‑Employed Health Insurance) | Low 🔄 (above‑the‑line claim) | Moderate ⚡: policy statements, premium receipts | High 📊: reduces AGI directly | Self-employed individuals paying family premiums | Above‑the‑line deduction; covers family members |

| Charitable Contributions & Donations | Medium 🔄 (itemizing, appraisal rules) | Moderate ⚡: receipts, acknowledgment letters, appraisals | Medium‑High 📊: meaningful if itemized and sizable | Donors giving cash, securities, or high‑value items | Tax‑efficient giving (esp. appreciated securities) |

| Home Office Utilities & Services Deduction | Low–Medium 🔄 (allocation by percentage) | Moderate ⚡: utility bills, allocation method, subscription records | Low–Medium 📊: recurring small savings add up | Home-based workers with proportional internet/phone use | Often overlooked; easy proportional calculation |

| Office Supplies & Equipment Deduction | Low–Medium 🔄 (Section 179/depreciation rules) | Moderate ⚡: receipts, asset inventory, Form 4562 | Medium–High 📊: immediate expensing possible under Section 179 | Startups and businesses purchasing computers/equipment | Immediate write‑offs; boosts cash flow for purchases |

| Insurance Premiums Deduction (Business Liability & Property) | Low 🔄 (ordinary business expense) | Low ⚡: policy documents and premium records | Low–Medium 📊: offsets insurance costs | Businesses needing liability, property, or workers’ comp | Essential protection with clear deductibility |

| Research & Development Tax Credit | High 🔄 (complex eligibility & documentation) | High ⚡: contemporaneous project records, payroll tracking, Form 6765 | High 📊: dollar‑for‑dollar tax reduction; sometimes refundable | Tech, biotech, manufacturing, software development | Direct credit vs. deduction; large savings for R&D spendments |

Turn Missed Deductions into Maximum Savings

Navigating the landscape of tax deductions can often feel like searching for hidden treasure without a map. As we’ve explored, from the intricacies of the home office deduction to the often-overlooked medical expense write-offs, numerous opportunities exist to significantly lower your taxable income. The primary reason these valuable deductions are missed isn’t a lack of eligibility, but rather a combination of unawareness and the perceived burden of meticulous record-keeping. The difference between a good tax return and a great one often lies in the details you capture throughout the year, not just in the frantic days leading up to the filing deadline.

This exploration of common tax deductions missed reveals a powerful theme: proactive tracking is the cornerstone of a successful tax strategy. Whether it’s logging every business mile, saving receipts for professional development courses, or documenting the fair market value of donated goods, consistent documentation transforms potential deductions from abstract concepts into concrete, defensible savings. The key is to build simple, repeatable habits and leverage modern tools to do the heavy lifting for you.

From Overlooked to Optimized: Key Takeaways

The journey to tax optimization is paved with small, consistent actions. Here are the most critical takeaways to implement immediately:

- Systemize Your Record-Keeping: Don’t rely on memory or a shoebox full of crumpled receipts. Designate a digital or physical system for every category of potential deduction, whether it’s for business expenses, medical bills, or charitable giving. Consistency is your greatest ally against leaving money on the table.

- Understand the “Why” Behind the Deduction: Knowing that a home office deduction exists is one thing; understanding the exclusive and regular use test is another. By grasping the specific qualification criteria for each deduction, you can confidently determine your eligibility and gather the correct supporting documentation from the start.

- Embrace Specialization for Charitable Giving: For many, charitable non-cash donations represent one of the most significant and frequently missed opportunities. With the deprecation of ItsDeductible, many taxpayers were left searching for a reliable ItsDeductible replacement. This is precisely where a specialized tool becomes indispensable.

Actionable Next Steps to Secure Your Savings

Knowledge without action is just trivia. To turn these insights into tangible financial benefits, focus on these immediate steps:

- Conduct a Self-Audit: Review the list of deductions covered in this article. Which ones might apply to your situation from the previous year or the current one? Make a personalized checklist and identify where you need to improve your tracking methods.

- Choose Your Tools Wisely: Select apps and software that simplify your life. A dedicated mileage tracker for your vehicle, accounting software for your small business, and a specialized tool for charitable donations can automate much of the process. For those non-cash contributions, as well as cash and mileage donations, DeductAble offers a modern, intuitive solution designed to fill the void left by ItsDeductible, ensuring you get full credit for your generosity.

- Schedule Regular Check-ins: Set a recurring calendar appointment, perhaps monthly or quarterly, to review and organize your receipts and records. This small habit prevents the overwhelming year-end scramble and ensures no common tax deductions are missed.

Ultimately, mastering your tax deductions is an act of financial empowerment. It’s about ensuring the money you’ve earned works for you in the most efficient way possible. By shifting your mindset from reactive tax preparation to proactive financial management, you transform tax season from a period of stress into a moment of strategic advantage. You are not just a taxpayer; you are the CFO of your own life. Start today, and make this the year you claim every single dollar you deserve.

Ready to stop guessing the value of your donated goods and start maximizing your charitable deductions with confidence? We developed DeductAble as the modern, user-friendly replacement for ItsDeductible, helping you meticulously track and value your non-cash contributions. Visit DeductAble.ai to see how you can turn your generosity into significant tax savings.