Maximize Your Donation: Using a Donate Car Tax Deduction Calculator

So, you’ve decided to donate your car—a fantastic way to support a cause you care about while potentially gaining a valuable tax break. But when it comes to tax time, how much can you actually deduct? It’s not always straightforward, and the answer hinges on one crucial detail: what the charity actually does with your car.

A good donate car tax deduction calculator can walk you through the specifics, but the bottom line is your deduction will be either the vehicle’s final sale price or its Fair Market Value (FMV). The IRS has clear rules that determine which value you can claim. Understanding them is the key to maximizing your itemized tax deductions and ensuring you get the full benefit you deserve.

How to Calculate Your Car Donation Tax Deduction

When you hand over the keys to your old car, you’re not just giving away a vehicle; you’re also unlocking a potential tax benefit. But the path to claiming that deduction isn’t always a straight line. The amount you can write off depends entirely on the charity’s next move.

The rules for this got a major overhaul with the American Jobs Creation Act of 2004. Before this law, donors often claimed inflated “fair market values” that didn’t reflect reality. The new rules, which kicked in back in 2005, tied the deduction directly to the car’s actual sale price in most situations, creating a more transparent system.

The impact was immediate and massive. The number of tax returns claiming vehicle deductions plummeted by more than 65% in a single year as the stricter guidelines took hold.

Understanding Your Deduction Amount

To maximize your deduction, you first need to figure out which valuation method applies to you. The IRS rules are designed to prevent overvaluation and ensure the deduction reflects the real value the charity received. For most donors, this means your deduction is capped at the gross proceeds the charity gets from selling the car, usually at auction.

But there are a few important exceptions that let you claim the full Fair Market Value, which is often a higher number. You can claim the FMV if:

- The charity decides to keep the vehicle and use it for its own operations (like delivering meals or transporting people).

- The organization makes “significant material improvements” to the car before selling it.

- The charity gives the vehicle away or sells it to a person in need for a price well below its market value.

A key takeaway here is that you absolutely must have the paperwork to back up your claim. Whether it’s the official Form 1098-C from the charity showing the sale price or a qualified appraisal for its FMV, documentation is non-negotiable.

Here’s a quick summary to help you see which rule applies to your situation.

Car Donation Deduction Scenarios at a Glance

| Scenario | What You Can Deduct | Deduction Cap |

|---|---|---|

| Charity sells the car as-is | The actual sale price | Capped at what the car sold for |

| Charity uses the car for its mission | The Fair Market Value (FMV) | Your car’s FMV on donation date |

| Charity improves the car before sale | The Fair Market Value (FMV) | Your car’s FMV on donation date |

| Charity gives/sells car to the needy | The Fair Market Value (FMV) | Your car’s FMV on donation date |

As you can see, the charity’s actions directly determine your tax benefit. This is why keeping meticulous records is so critical.

Properly documenting your non-cash contributions is the most important step in claiming the deduction you’ve earned.

Fair Market Value vs. Sale Price Explained

When you donate a vehicle, how much you can deduct on your taxes comes down to one simple question: What did the charity do with the car?

The IRS has two different paths for valuing your donation. One is based on the car’s gross sale price, and the other is based on its Fair Market Value (FMV). The path you follow isn’t up to you—it’s dictated entirely by the charity’s actions after you hand over the keys. Getting this right is the first step to using any donate car tax deduction calculator correctly.

The most common outcome is that the charity sells your car, usually at an auction. In this scenario, the rule is straightforward: your tax deduction is the exact gross proceeds from that sale. Not a penny more, not a penny less.

This amount is officially reported to you by the charity on Form 1098-C, so there’s no guesswork involved. If the car sells for $1,800, your deduction is $1,800. If it only brings in $450, your deduction is capped right there (unless it’s under $500, which has its own special rule). This keeps things simple by tying your deduction directly to the actual cash benefit the charity received.

When You Can Claim Fair Market Value

While the sale price rule is the default, there are a few key exceptions that let you claim the car’s Fair Market Value—which can often be a much higher number. This is a huge advantage, but it only applies in specific situations where the charity puts your car to work for its mission instead of just selling it for parts.

You’re allowed to deduct the FMV if the charity does one of three things:

- Uses the vehicle in its operations. This means the charity makes significant use of the car to directly further its mission. Think of a food bank using your donated van for deliveries or a nonprofit using your old sedan to shuttle clients to appointments.

- Makes material improvements. This is more than just a car wash and an oil change. The charity has to make substantial repairs or upgrades before selling the vehicle.

- Gives or sells the car to a person in need. Some charities have programs where they transfer a vehicle to a low-income family for free or at a price far below market value. This directly helps someone get back on their feet.

In these cases, your donation’s value isn’t just the auction cash—it’s the real-world utility the car provided to the cause.

How to Determine Fair Market Value

So, if your donation qualifies for an FMV deduction, how do you figure out that value? The IRS has a clear definition.

Fair Market Value is the price a willing buyer would pay and a willing seller would accept for the property, when neither is forced to buy or sell and both have reasonable knowledge of the relevant facts.

For a car, this boils down to its private-party sale value. It’s not what a dealer would sell it for on their lot, and it’s definitely not the trade-in value. You need to determine what someone would realistically pay for it based on its make, model, year, mileage, and overall condition when you donated it.

To nail down an accurate FMV, turn to a trusted used car price guide like Kelley Blue Book or Edmunds. And be honest. Note the dents, the weird engine noise, and the worn-out tires. An accurate, defensible valuation is everything. The logic is similar to valuing other non-cash items, a concept we cover more broadly in our Goodwill donation value guide.

Calculating Your Deduction Step by Step

Okay, let’s get down to brass tacks. It’s one thing to know the rules, but it’s another to see how they actually play out with real numbers. Walking through the process from start to finish is the best way to understand how a donate car tax deduction calculator works and feel confident when you file.

The journey starts the second you hand over the keys, but it’s what the charity does next that really matters. The path your deduction takes depends entirely on their next move.

This visual breaks down the two main outcomes for your donation. As you can see, how the charity handles your car directly shapes your final tax deduction.

While both scenarios begin with your generosity, the end result—your actual deduction—is determined by whether the charity sells the vehicle or puts it to work for their mission.

A Tale of Two Donations

To really see this in action, let’s imagine a donor named Alex who’s giving away a 2012 sedan. After a bit of research, Alex figures out the car’s Fair Market Value (FMV) is around $2,500. That’s a great starting point, but it’s not the final number.

What happens next is what counts. We’ll look at two possible futures for Alex’s car: one where it’s sold at auction, and another where the charity uses it in one of its programs. This side-by-side look will make it crystal clear why the rules are so important.

Scenario A: The Car Is Sold by the Charity

In our first scenario, the charity takes Alex’s sedan and sends it straight to a local auto auction. This is super common—it’s a fast, efficient way for nonprofits to turn a car into cash they can use right away.

A few weeks later, Alex gets Form 1098-C in the mail. This is the official IRS document you need, and it holds the key to your deduction. It states that the car sold for $1,200.

Because the charity sold the car as-is, Alex’s deduction is capped at that exact sale price. The initial $2,500 FMV is now completely off the table for tax purposes. The sale price is the only number that matters.

The rule is simple: if the charity sells your car, your deduction is whatever they sold it for. It doesn’t matter what you thought it was worth; the IRS only lets you claim the actual cash the charity received.

This is a critical point that trips up a lot of donors. A high FMV doesn’t mean a high deduction if the car is just flipped for cash.

Scenario B: The Car Is Used by the Charity

Now, let’s rewind and imagine a different outcome. This time, the charity that receives Alex’s car runs a program helping single mothers get to work. Instead of selling the sedan, they give it directly to a family who needs reliable transportation.

This one decision changes everything for Alex’s tax deduction. Because the charity used the car to directly advance its charitable mission, Alex is now allowed to claim the car’s full Fair Market Value.

A few weeks after donating, Alex receives a written acknowledgment from the charity. This letter confirms they won’t sell the car and are using it in their program. This piece of paper is the proof Alex needs to claim the higher FMV.

Example Calculation Walkthrough

Let’s put these two scenarios next to each other to see the real financial impact. The table below shows just how dramatically the charity’s actions can alter the tax outcome for the exact same car.

| Calculation Step | Scenario A: Car Sold by Charity | Scenario B: Car Used by Charity |

|---|---|---|

| Initial FMV of Car | $2,500 | $2,500 |

| Action Taken by Charity | Sells the car at auction | Gives the car to a family in need |

| Amount on Form 1098-C | Gross sale price of $1,200 | N/A (written acknowledgment provided) |

| Final Allowable Deduction | $1,200 | $2,500 |

The difference is stark. Alex’s deduction is more than double in Scenario B, all because of how the charity used the donation. This is a powerful reminder of why it pays to understand the rules before you donate and to keep flawless records of every single step.

The Essential IRS Forms and Paperwork for Your Donation

Getting your car donation paperwork right isn’t just a friendly tip from your accountant—it’s a hard-and-fast rule from the IRS. If you want to claim that deduction, you absolutely have to prove the value of your contribution with the right documents. Without them, even the most generous gift won’t stand a chance if the IRS comes knocking.

Think of your paperwork as the concrete foundation for your tax deduction. A donate car tax deduction calculator is great for a ballpark estimate, but it’s the official forms and receipts that make your claim stick. Let’s walk through exactly what you need to have in hand.

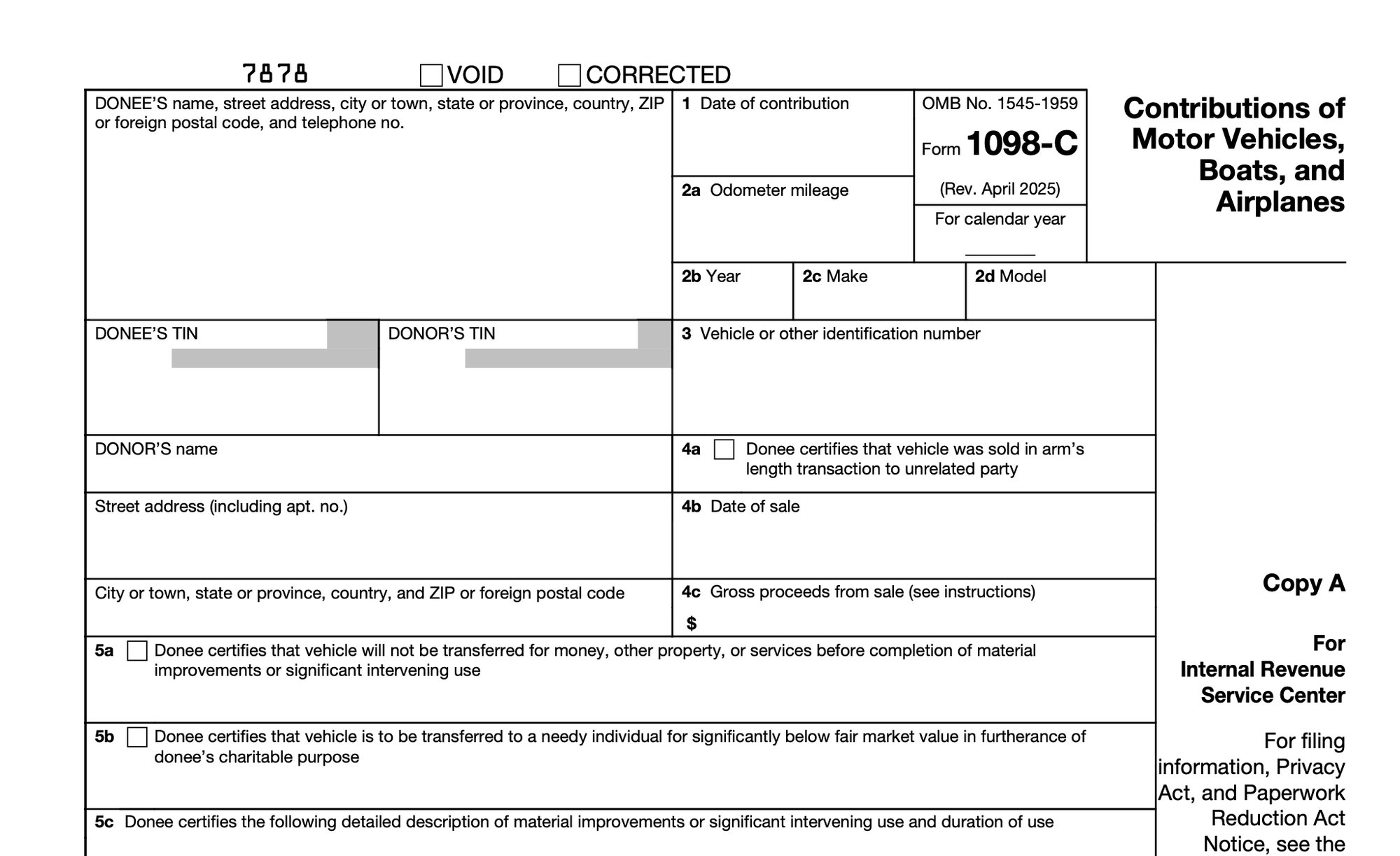

The Most Important Document: Form 1098-C

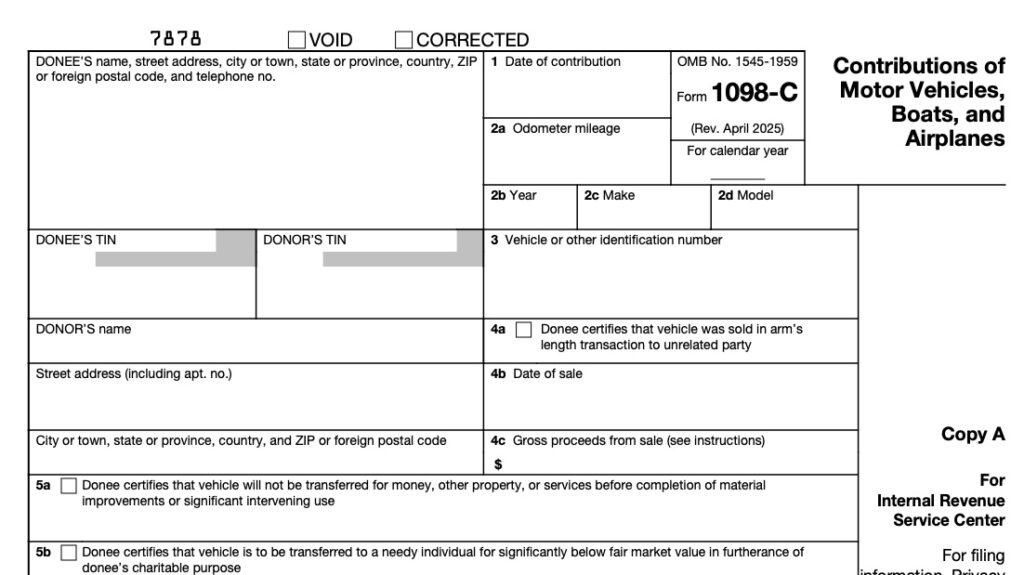

If there’s one piece of paper that matters most, it’s Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. This is your official receipt from the charity, and it’s what tells you the maximum amount you can deduct if they sell your car. The charity must send this to you within 30 days of the sale.

This form lays out all the critical details:

- Your name and taxpayer ID number.

- The vehicle identification number (VIN).

- The date you made the contribution.

- And the most important part: the gross proceeds the charity got from selling your car.

If the charity sells your vehicle, the number you see in Box 4c (“Gross proceeds from sale”) is your deduction limit. There’s no wiggle room here—that’s your final number.

Getting to Know Form 8283 for Noncash Donations

Things get a little more involved if your total deduction for all noncash gifts for the year (your car included) is more than $500. At that point, you’ll also need to file Form 8283, Noncash Charitable Contributions, along with your tax return. This form gives the IRS a clearer picture of what you donated.

You’ll fill out one of two sections, depending on the value of your donation.

Section A of Form 8283

You’ll use this section for noncash donations valued between $501 and $5,000. Here, you’ll list the charity’s name, describe what you gave (like a “2010 Honda Accord”), and note the donation date, how you got the car, and its fair market value.

A common trip-up is assuming you can skip this form if your car sold for over $500 but you thought its FMV was less. The IRS rule is simple: if you claim a deduction of more than $500, you have to file Form 8283.

Section B of Form 8283

This section is reserved for any single item, including a vehicle, that you value at more than $5,000. The rules get much stricter here, and you will almost certainly need a qualified written appraisal from a professional.

The charity and the appraiser both have to sign this section, certifying that everything is accurate. Trying to claim a high-value donation without a proper appraisal is one of the quickest ways to get your deduction denied. Our guide on donating your car to charity dives deeper into navigating these rules.

Why Keeping Good Records is Non-Negotiable

Beyond the official IRS forms, you need to keep your own thorough records to back up your claim. This is your first line of defense if the IRS ever has questions. Your files should be complete and organized, leaving no doubt that your deduction is legit.

Here’s what you should have in your file:

- A copy of the vehicle title transfer showing the charity as the new owner.

- The original Form 1098-C or a written acknowledgment from the organization.

- A few photos of the vehicle at the time of donation to document its condition.

- The qualified written appraisal if your deduction is over $5,000.

- Your own notes on how you determined the Fair Market Value, if that rule applies.

Common Car Donation Mistakes to Avoid

Donating a car feels great, but a few simple missteps can turn your generous act into a major tax headache. The IRS has specific rules, and one wrong move can jeopardize your entire deduction or, worse, trigger an audit.

Think of it like this: using a donate car tax deduction calculator gets you the numbers, but avoiding these common pitfalls is what makes those numbers stick. Let’s walk through the mistakes that trip people up most often.

Overvaluing Your Vehicle

This is the big one. It’s so tempting to look up your car’s model in a price guide and pick the highest number you see, but that’s not how it works. The IRS wants the Fair Market Value (FMV), which is what a real buyer would pay for your specific car in its current condition—dents, high mileage, weird engine noise, and all.

If you claim a pristine value for a car that’s seen better days, you’re overstating your deduction. If an audit happens, that deduction could be completely disallowed, and you might even get hit with penalties. The key is to be honest and document why you valued it the way you did.

Donating to an Ineligible Organization

Here’s another trap: not all organizations that take car donations are actually “qualified” charities according to the IRS. For your donation to be deductible, it absolutely must go to a qualified 501(c)(3) organization. If you give your car to a political group, a for-profit company, or an unlisted nonprofit, you get a warm feeling but a $0 tax deduction.

Before you even think about handing over the keys, do a quick check:

- Use the IRS Tool: Jump on the official Tax Exempt Organization Search tool on the IRS website. It’s the definitive source.

- Ask the Charity Directly: Don’t be shy. Ask them for a copy of their IRS determination letter that proves their 501(c)(3) status.

This takes five minutes and is the single most important step to protect your deduction.

Failing to Transfer the Title Correctly

This is a surprisingly common and potentially costly mistake. If you don’t formally sign the title over to the charity, you might still be the legal owner. That means you could be on the hook for parking tickets, towing fees, or even accidents that happen long after the car has left your driveway.

A simple rule to live by: never, ever leave the “buyer” or “transferee” line on the title blank. Always write in the charity’s full, official name and make sure an authorized person from the charity signs it. This is your proof that the car is officially their problem now, not yours.

Keeping Incomplete or Messy Records

Finally, even if you do everything else right, sloppy paperwork can kill your deduction. If the IRS asks for proof and all you have is a crumpled receipt, they can deny your claim. No questions asked.

You absolutely must keep copies of the title transfer, the official Form 1098-C (or a detailed written acknowledgment) from the charity, and any appraisal documents you used.

Common Questions About Donating a Car

Even with a handy donate car tax deduction calculator, a few tricky situations always seem to pop up. Let’s walk through some of the most common questions donors ask, so you can feel completely confident in your donation.

What If My Car Sells for Less Than $500?

This is a great question, and it highlights a special rule that can actually work in your favor. If the charity sells your car for $500 or less, the IRS lets you deduct the lesser of its Fair Market Value (up to $500) or what it actually sold for.

Let’s say your car’s Fair Market Value was a solid $700, but it only fetched $350 at auction. In this case, you can claim a $500 deduction. The charity still needs to give you a written acknowledgment of the gift, but they aren’t required to send the official Form 1098-C for sales at or below this amount.

Do I Have to Itemize to Claim the Deduction?

Yes, this is non-negotiable. To claim a deduction for your donated vehicle, you absolutely must itemize your deductions on Schedule A of your Form 1040. If you take the standard deduction, you can’t claim the car donation.

Before you donate, it’s a smart move to quickly check if your total itemized deductions—your car, plus things like state taxes, mortgage interest, and other charitable gifts—will add up to more than the standard deduction for your filing status.

Can I Deduct Expenses Like Towing Fees?

Towing fees are almost never deductible because the charity handles and pays for that service nearly 100% of the time. However, you might have other out-of-pocket costs related to the donation that you can deduct.

For instance, if you paid for a professional appraisal to determine your car’s value (which is required for any claim over $5,000), that appraisal fee is considered part of your charitable contribution. It’s easy to forget these smaller expenses, but they add up.

Stop losing track of your generosity. With DeductAble, you can easily document every donation, from cars to clothes, and feel confident at tax time. Download the app and start maximizing your deductions today at https://deductable.ai.